SIRIUS XM HOLDINGS (SIRI)·Q4 2025 Earnings Summary

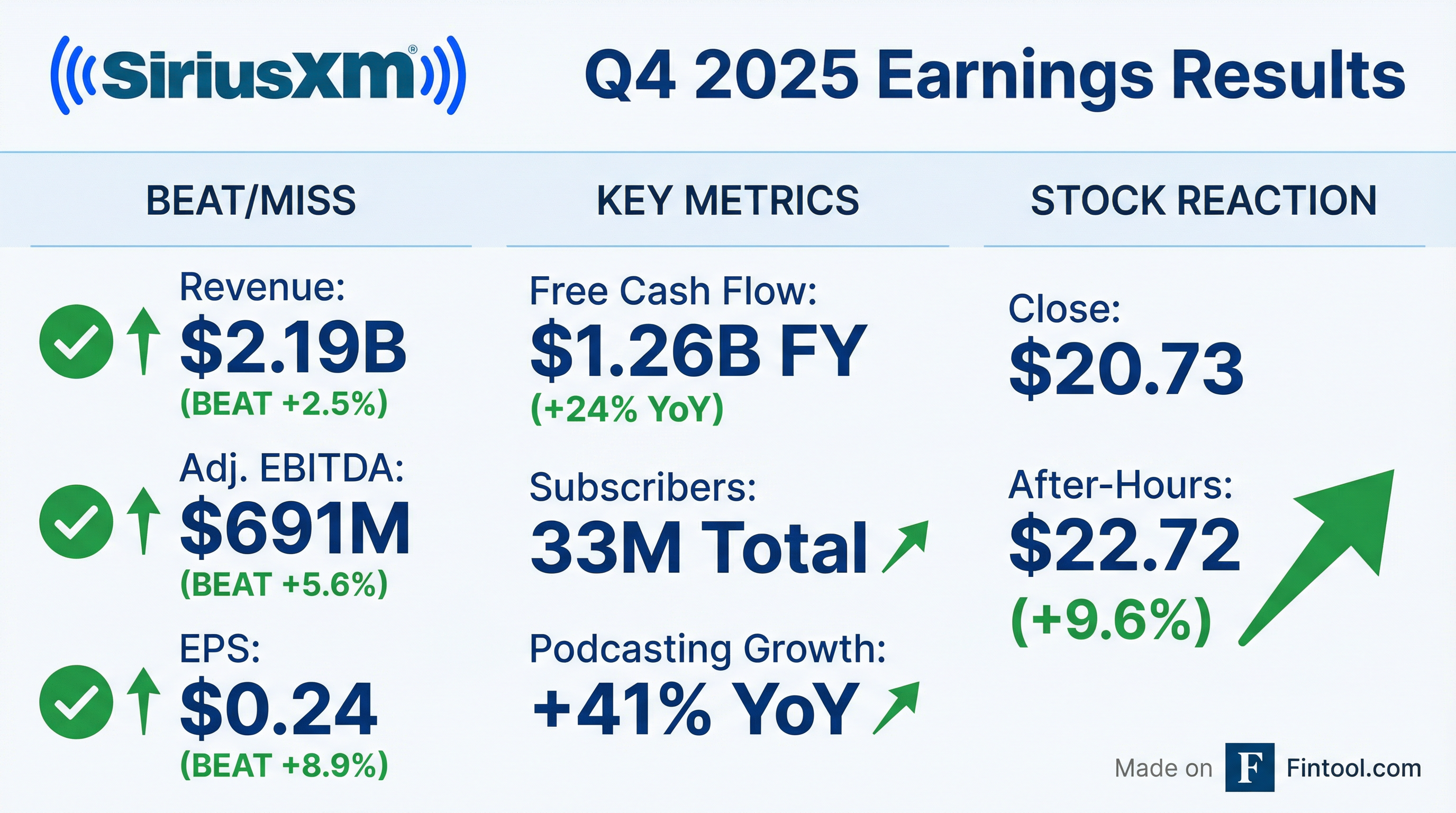

SiriusXM Beats on All Metrics, Stock Surges 10% as Free Cash Flow Hits $1.26B

February 5, 2026 · by Fintool AI Agent

SiriusXM delivered a clean beat across all key metrics in Q4 2025, exceeding raised guidance and demonstrating financial discipline as a newly independent public company. The stock surged nearly 10% in after-hours trading to $22.72, as investors cheered the $1.26 billion in full-year free cash flow (+24% YoY) and the renewal of Howard Stern for three more years.

Did SiriusXM Beat Earnings?

Yes — a triple beat. SiriusXM exceeded consensus estimates on revenue, Adjusted EBITDA, and EPS:

Full-year 2025 results also exceeded guidance:

- Revenue: $8.56B (guidance was ~$8.5B)

- Adjusted EBITDA: $2.67B (beat internal targets)

- Free Cash Flow: $1.26B (+24% YoY, well above expectations)

The company achieved $250 million in incremental gross cost savings during 2025, contributing to margin stability despite revenue headwinds.

How Did the Stock React?

The market rewarded the beat decisively:

The stock had been under pressure, trading near 52-week lows before earnings. The combination of beat-and-raise, cost discipline, and the Stern renewal catalyzed a sharp recovery.

What Did Management Guide?

SiriusXM provided stable 2026 guidance with a clear path to continued FCF growth:

The company reiterated its path to $1.5 billion FCF by 2027, representing continued improvement from the $1.0B achieved in 2024. Management also targets an additional $100M of gross cost savings exiting 2026 (for a cumulative run rate of $350M), driven by platform efficiencies, customer service automation, and G&A rationalization.

CEO Jennifer Witz commented: "We entered 2025 with renewed strategic focus as a fully independent public company, and we're pleased to have overdelivered on our commitments... In 2026, we are providing robust guidance that we believe reflects the overall stabilization of the business."

New CFO Zach Coughlin (his first earnings call, started January 1): "This is a business with strong competitive positioning, durable cash flow, and a clear roadmap for continued efficiency and profitability." On his priorities: "I've been incredibly impressed by the depth of the team, the durability of this business, and the passion behind our brands."

What Changed From Last Quarter?

Subscriber Dynamics Improving

The headline subscriber story showed signs of stabilization:

Key developments:

- Companion Plans launched earlier than expected in December, adding ~80K incremental self-pay subscribers — allows loyal full-price customers to add a vehicle or streaming login at no additional cost

- Continuous Service reduces friction when subscribers change vehicles — maintains listening history, account credentials, and keeps streaming active during transitions

- 360L penetration now in 50%+ of new SiriusXM-enabled vehicles, now available in all new Volvos, standard on Audis, debuting in 2026 Toyota RAV4

- Dealer subscription program now live with 15+ automotive brands in new and used vehicles

Pandora Segment Pressures

Pandora and Off-Platform continues to face structural headwinds:

However, podcasting grew 41% in 2025 on top of 12% growth in 2024, and the SiriusXM Podcast Network became #1 in weekly listener reach per Edison Research.

Key Segment Performance

SiriusXM (Core Satellite Radio) — $6.42B Revenue (-2% YoY)

The revenue decline reflects a smaller average self-pay subscriber base and more customers on promotional plans, partially offset by rate increases.

Pandora and Off-Platform — $2.14B Revenue (Flat)

Advertising growth was driven by podcasting, programmatic, and technology fees, offset by reduced advertiser demand in streaming music.

Capital Allocation & Balance Sheet

SiriusXM returned $501 million to shareholders in 2025:

Balance sheet highlights:

The company paid down $699M in long-term debt during 2025 and targets a low-to-mid 3x leverage ratio by Q4 2026.

Programming Highlights

Key content wins in Q4 2025:

- Howard Stern renewed for 3 additional years — CEO Witz noted 32% YoY increase in earned media with A-list interviews

- Megyn Kelly launched full-time channel in Q4

- Chris Cuomo joined in 2026 with exclusive daily political show on POTUS Channel

- Metallica channel outperforming benchmarks; Unwell Music channel with Alex Cooper showing strong engagement

- New basketball and soccer programming debuted (NBA deal extended, Italy's top soccer league coverage)

- Half of Golden Globe nominees in first-ever Best Podcast category came from SiriusXM network

The company continues to expand cross-platform sales, integrating social and video inventory from top creators like MrBallen — video and social revenue up 4x YoY.

Q&A Highlights

Competitive Positioning

CEO Jennifer Witz emphasized SiriusXM's unique position: "We are complementary to the music streaming services, especially because we have a unique position in the car. The vast majority of listening in the car is still to AM/FM, and we are opening up new packages, including music only at $9.99 and low cost with ads at $7 that goes squarely against that AM/FM listening."

Advertising Category Trends

Management provided color on ad demand: "Tech is up the most, financial services and pharma have been strong, as well as CPG. Where we're seeing some pressure is on retail, QSR, and education." Podcast programmatic demand was up 92% YoY in Q4.

Podcast Profitability

On podcasting margins: "This is a good business for us. It stands on its own. The margin has increased over time, and we think that the industry dynamics are in our favor here."

Spectrum Strategy Update

Regarding the 35 MHz of spectrum: "We are evaluating multiple approaches to creating value with these assets, including new products or enhancements to our services... with a bit more attention being paid to the C and D licenses within WCS, that's where the most near-term opportunities are."

360L Conversion Advantage

On conversion rates: "360L conversion rates are better than non-360L. We even see, it's pretty early, but we launched 360L on AAOS, which is a platform that we can more easily update... we even see better conversion rates there." Used car trial penetration is now at 60%, approaching a 50/50 split with new car trials.

New CFO's Capital Allocation Framework

CFO Zach Coughlin (first earnings call): "We're first focused on investing in initiatives that drive our strategy... the good news is with the OpEx efficiency work we're doing, we're able to create the capacity to both invest and improve free cash flow. On deleveraging, we made significant progress, going down to 3.6x, and we expect to get into our guided range of low- to mid-3s by later this year... then the third return is to shareholders. Today, that's been more heavily weighted toward dividends, and that will remain important."

Auto Industry Headwinds

On 2026 outlook: "There does look to be perhaps the first year of reductions in consumer purchases of new vehicles, at least from third-party estimates, the first time since 2022. So we may be facing a bit of a headwind there." However, expansion of 360L penetration is helping offset this pressure.

Risks and Concerns

Subscriber pressures persist: Total subscribers declined 299K YoY, and the trial funnel is shrinking. The core satellite radio business faces secular headwinds from streaming competition.

ARPU compression: Average revenue per user declined $0.10 YoY to $15.11, reflecting promotional pricing pressure.

Auto industry dependence: CEO Witz noted 2026 could be "the first year of reductions in consumer purchases of new vehicles... the first time since 2022," creating trial start headwinds.

Pandora struggles: Monthly active users declined 5% to 41.1M, and streaming music advertising demand remains weak.

Impairment charges: The company recorded $436M in impairment, restructuring, and other costs in 2025 (including $272M in Q4), driven largely by non-cash impairments related to certain content-related agreements and terminated software projects.

Forward Catalysts

- FCF Growth Path: Targeting $1.5B FCF by 2027 from $1.26B in 2025

- Leverage Reduction: Expecting to hit low-to-mid 3x by late 2026

- 360L Expansion: Continued rollout across 180M enabled vehicle fleet; now debuting in 2026 Toyota RAV4

- Podcasting Momentum: #1 network position with 41% growth; expanding Amazon DSP partnership

- Rate Increase Coming: Management indicated pricing power remains with "more room in ARPU and pricing" and companion plans position well for a 2026 rate increase

- Spectrum Monetization: Evaluating WCS C and D licenses for near-term opportunities

- Super Bowl & World Cup: Building major event packages to drive advertising and engagement

The Bottom Line

SiriusXM delivered exactly what investors needed: a clean beat, exceeded guidance, and continued FCF growth. The Howard Stern renewal removes a key overhang, and the company's cost discipline is translating to margin stability despite top-line pressures.

The core challenge remains unchanged — satellite radio faces secular headwinds, and Pandora is losing users. But with the stock trading at just ~5x 2026E FCF and management committed to shareholder returns, the risk/reward has improved materially.

View more on SiriusXM | Q4 2025 Earnings Transcript | Prior Quarter: Q3 2025